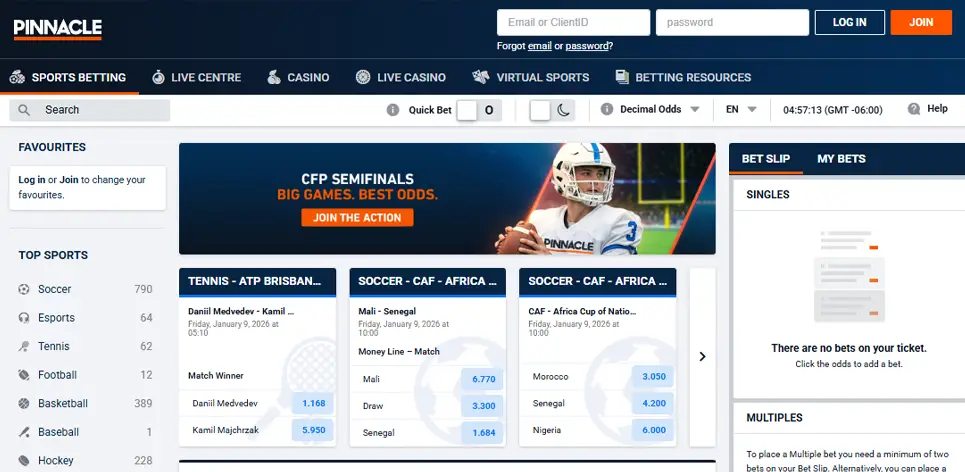

In sports betting, one phrase carries more weight than any marketing slogan: sharp lines. Among professional bettors, traders, and even competing sportsbooks, Pinnacle is widely regarded as the operator that produces the sharpest, most efficient odds in the world.

Their lines are so respected, in fact, that entire betting strategies are built around them. Professional bettors monitor Pinnacle to understand where the “true” price is moving. Smaller sportsbooks watch Pinnacle to help shape their own markets. Analysts use Pinnacle closing lines as a benchmark for measuring efficiency.

This raises an obvious question. How does one bookmaker with the same teams, same games, and same information as everyone else consistently create better odds?

The answer lies in a combination of trading philosophy, technology, pricing discipline, and a willingness to welcome sharp bettors that most sportsbooks try to avoid. Pinnacle does not fear informed action. It invites it — and then uses that information to make its odds even stronger.

This article breaks down the mechanics behind Pinnacle’s pricing model, explains how their lines influence the broader market, and explores why Pinnacle’s odds have become the closest publicly available approximation of true probability in sports betting.

What “Sharp” Lines Really Mean

Before understanding how Pinnacle creates sharp lines, it’s important to define the term.

A sharp line is one that accurately reflects the true probability of an outcome. It is:

-

resistant to manipulation

-

shaped by informed money

-

efficient at closing (minimal mispricing by kickoff)

-

stable under volume

Think of a sharp line as the final, corrected number after the market has absorbed all credible information: injuries, weather, situational factors, analytics, and professional insight.

A soft line, by contrast, can be beaten repeatedly because it:

-

moves slowly

-

overreacts to public opinion

-

limits sharp bettors

-

relies heavily on models without real market feedback

Most recreational sportsbooks fall into the second category, by design. Their business focuses on promotions, parlays, and bonuses, not price accuracy.

Pinnacle operates differently. Its mission is not to avoid sharp bettors, but to build the most accurate prices in the world, even if it means being beaten along the way.

Welcoming Winners: Why Sharp Bettors Are Central to Pinnacle’s Model

Where most sportsbooks reject sharp bettors, Pinnacle embraces them.

This counterintuitive decision is the cornerstone of what makes Pinnacle a market-maker rather than a follower. Instead of banning or limiting skilled bettors, Pinnacle uses its knowledge as a pricing input, and that creates a powerful feedback loop that continuously sharpens their odds.

The process begins with Pinnacle’s “winners welcome” philosophy. Professional bettors, syndicates, modelers, and arbitrage players are allowed to wager — often at meaningful limits — without being quietly removed from the platform. Pinnacle understands that sharp bettors don’t beat sportsbooks because of luck; they beat them because they identify inefficiencies. By allowing these players to participate, Pinnacle gains real-time insight into where its odds are misaligned with informed opinion.

Sharp bettors:

-

Find mispriced lines

-

reveal hidden information faster than models can

-

remove inefficiencies that distort true probability

In other words, winning bettors help Pinnacle.

Instead of banning them, Pinnacle uses their knowledge to make its lines harder to beat.

A common misconception is that sharp bettors “beat” Pinnacle long term. In reality, Pinnacle profits through volume and low margins, while sharp action improves pricing quality across the book.

The sharper the bettors, the stronger the odds become. That is why Pinnacle refers to itself as a place where winners are welcome because sharp bettors are not a liability. They are part of the system.

The Trading System: How Pinnacle Engineers Efficient, Data-Driven Odds

At the heart of Pinnacle’s reputation for precision is its trading system, a sophisticated blend of statistical modeling, human expertise, and automated technology designed to constantly refine prices. Unlike many sportsbooks that prioritize “protecting the house” from sharp bettors, Pinnacle structures its trading desk like a financial market.

Their goal is not to avoid risk entirely, but to manage it intelligently while allowing the odds themselves to reflect real information coming in from the market. Risk management begins long before bets are even taken. Pinnacle models expected bet volume, historical market behavior, and variance across different sports, leagues, and markets.

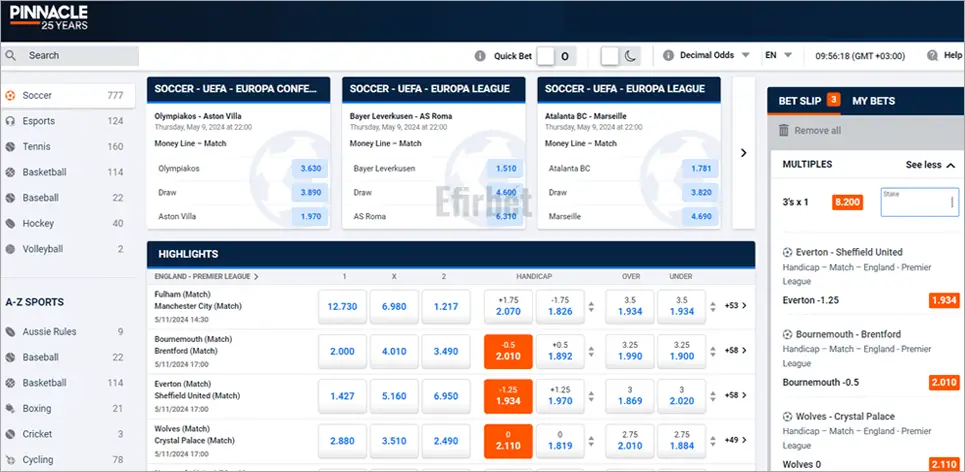

A Premier League match, for example, behaves differently from a mid-week tennis Challenger event. Each market has a risk tolerance assigned to it, dictating how aggressively odds can move and how much exposure Pinnacle is comfortable carrying at different price points. Rather than setting arbitrary limits, Pinnacle allows limits to scale with market maturity, small early, and larger as more information flows into the market.

Real-time data processing plays an equally critical role. Pinnacle ingests injury reports, lineup announcements, referee assignments, weather models, historical matchup data, and advanced performance metrics.

These aren’t static datasets; they’re streamed continuously and processed with automated rules that can trigger odds adjustments within seconds. Where slower books may take minutes or longer to react, Pinnacle’s systems are designed to stay synchronized with the reality unfolding around the event.

Statistical modeling is the backbone of these operations. Using tools like R programming, Pinnacle builds probabilistic models that estimate true outcomes over thousands of simulated game states. These models incorporate pace of play, expected goals, regression indicators, prior distributions, and market elasticity.

The output is a “fair” line before the margin is added. From there, Pinnacle overlays its margin (vig), applies liquidity assumptions, and sets a starting price that’s intentionally open to market feedback.

How Data, Sharps, and Algorithms Drive Pinnacle’s Odds

Odds adjustment algorithms then take over as bets arrive. Every wager isn’t treated the same. A maximum-limit bet from a proven sharp bettor carries far more informational value than ten recreational $25 bets. Pinnacle’s algorithms weigh the source, timing, price sensitivity, and historical performance profiles. If strong bettors repeatedly attack a side, the algorithm shifts the price not only to reduce exposure, but also because the bet itself is likely informative about the true probability.

All of this is supported by an experienced trading team. Pinnacle traders are not simply button-pushers reacting to automated signals; they act more like portfolio managers. They monitor liquidity, spot market manipulation attempts, compare internal prices against global benchmarks, and override models when context demands human judgment.

The result is a trading environment that resembles a high-frequency financial exchange more than a traditional sportsbook. Models produce a starting point, algorithms process flow, human expertise refines signals, and risk systems ensure exposure remains rational. This process is why Pinnacle’s opening lines are respected and why their closing lines are often considered the closest reflection of true probability available anywhere in sports betting.

Why Other Sportsbooks Can’t Simply Copy the Model

Many operators have tried.

Most fail.

Because Pinnacle’s model requires:

-

low margins instead of high ones

-

high limits instead of restrictions

-

welcoming sharps instead of banning them

-

accepting volatility instead of avoiding it

-

long-term thinking instead of short-term profit chasing

Few operators are willing or able to commit to that level of discipline.

It requires technology, capital, confidence, and a corporate culture comfortable with sharp bettors.

Pinnacle has built that culture over decades.

The “Pinnacle Lean” Strategy

Among professional bettors, the phrase “Pinnacle lean” has become shorthand for using Pinnacle’s odds as a truth signal. Because Pinnacle’s closing odds are widely regarded as the most efficient numbers in the market, many bettors treat them as a benchmark not necessarily to bet at Pinnacle itself, but to identify mispriced opportunities elsewhere.

The process starts with de-vigging Pinnacle’s odds. Every sportsbook price includes a built-in margin (the “vig”), which slightly inflates both sides of the market. Removing that margin reveals Pinnacle’s estimate of the real underlying probability.

For example, if Pinnacle posts +120 on a side and another book offers +140, the difference is rarely accidental. In many cases, it means the softer book is lagging behind the information that has already been priced in at Pinnacle.

Professionals exploit these mismatches systematically, often betting the softer number while using Pinnacle only as a reference point. They are not guessing; they are essentially outsourcing probability estimation to the market leader.

This benchmarking extends beyond single bets. Syndicates track how often their wagers beat Pinnacle’s closing line, a metric called “closing line value” (CLV). Consistently beating Pinnacle’s final number is evidence that a bettor is correctly identifying inefficiencies. Failing to do so usually means the bettor is paying too much juice or consistently getting the worst of the number.

In practice, the “Pinnacle lean” strategy is less about copying bets and more about recognizing when the broader market is wrong. Sharp bettors don’t blindly assume Pinnacle is infallible, but they understand that if your number is consistently fighting Pinnacle’s closing line, the market is likely to win over time. Using Pinnacle as a benchmark provides direction, discipline, and context, three things recreational bettors rarely have.

Line Movement and Market Impact

When Pinnacle moves a line, the rest of the market usually reacts. That influence is not the product of hype or reputation; it is the result of structural credibility. Because Pinnacle’s lines are shaped by liquidity and sharp money, movement typically reflects meaningful new information rather than noise.

This is why “steam moves” often originate at Pinnacle. Steam refers to sudden, synchronized shifts across multiple sportsbooks. In many cases, the first visible move occurs at Pinnacle, followed quickly by copycat adjustments elsewhere.

Books that trail too far risk becoming targets for arbitrage, middles, and value hunters. To protect themselves, they watch Pinnacle closely, sometimes through automated monitoring tools that alert traders the moment Pinnacle adjusts.

Why Pinnacle Leads Market-Wide Line Movement

The causal chain is important. Pinnacle does not move because everyone else does; others move because Pinnacle has already processed sharper signals. A key injury leak, a lineup change, a weather shift, or a sharp syndicate position might hit Pinnacle first. Once the number is corrected, softer books scramble to catch up. The market appears to “move together,” but the leadership is clear.

This leadership extends to opening lines as well. In many sports, Pinnacle will post early prices with lower limits, inviting engagement from professionals. These lines function like test balloons. As sharp bettors weigh in, Pinnacle refines the numbers and increases limits. Other books wait, observe, and then mirror the stabilized version, effectively outsourcing their early risk and discovery process.

Of course, not all moves are created equal. Some are simple risk adjustments, others reflect deep informational shifts. Experienced bettors learn to distinguish between cosmetic shading and genuine steam driven by respected money. Because Pinnacle’s adjustments tend to be data-driven, their movements carry more informational weight than a smaller book overreacting to casual betting volume.

In practical terms, Pinnacle’s role in line movement defines the market’s center of gravity. Even sportsbooks that publicly position themselves as independent price makers privately calibrate against Pinnacle. The result is a market where efficiency radiates outward: Pinnacle sharpens first, then the industry converges.

Maintaining Accuracy at Scale

Producing sharp lines for a handful of marquee games would be impressive. Pinnacle does it across thousands of markets per day, pre-match, live, props, totals, derivatives, and alternative lines. Scaling precision at that level requires more than strong models; it requires disciplined systems, quality control, and relentless iteration.

Live betting presents the hardest challenge. Odds must update every few seconds while incorporating streaming data, scoreboard integrity checks, latency controls, and model recalibration. Pinnacle invests heavily in feed validation so bad data doesn’t corrupt prices. When delays occur, limits are temporarily lowered rather than forcing bets into unreliable numbers. The priority is accuracy first, liquidity second.

Consistency across sports is another layer. Soccer, baseball, MMA, tennis, and basketball require fundamentally different modeling logic. Variance profiles, scoring distributions, and tempo dynamics all differ. Pinnacle maintains specialized frameworks for each sport, overseen by traders and analysts with domain expertise. Errors are logged, back-tested, and used to retrain models, creating institutional learning rather than one-off fixes.

Quality control runs throughout the process. Internal dashboards monitor exposure, line divergence versus global benchmarks, and anomaly detection. If a price drifts too far without justification, it triggers review. Post-event analysis measures how often Pinnacle’s closing number aligned with observed probability, helping refine assumptions for future markets.

This is how accuracy becomes systematic rather than accidental. Through automation, controls, and continuous feedback, Pinnacle preserves sharpness even as volume, complexity, and market speed increase.

Conclusion: Why Pinnacle’s Accuracy Endures

By combining quantitative modeling, sophisticated risk systems, sharp-money feedback loops, and disciplined trading oversight, Pinnacle has built a sportsbook that functions more like a financial exchange. Accepting winners does not weaken their model; it strengthens it. De-vigged Pinnacle closing numbers serve as the industry’s closest proxy to true probability, and the broader market often moves in response.

That accuracy becomes a sustainable competitive advantage. It attracts professionals, increases liquidity, reduces variance, and reinforces Pinnacle’s role as a market-maker. As live betting expands, data becomes faster, and analytics grow more complex, sportsbooks that rely on guesswork and limitations will struggle to keep up.

Pinnacle’s approach suggests the future of sharp line-setting: transparent pricing, informational efficiency, and open markets where informed bettors help discover truth. For anyone serious about understanding sports betting math, from traders to bettors to analysts, Pinnacle remains the benchmark for what efficient odds truly look like.