Background Info

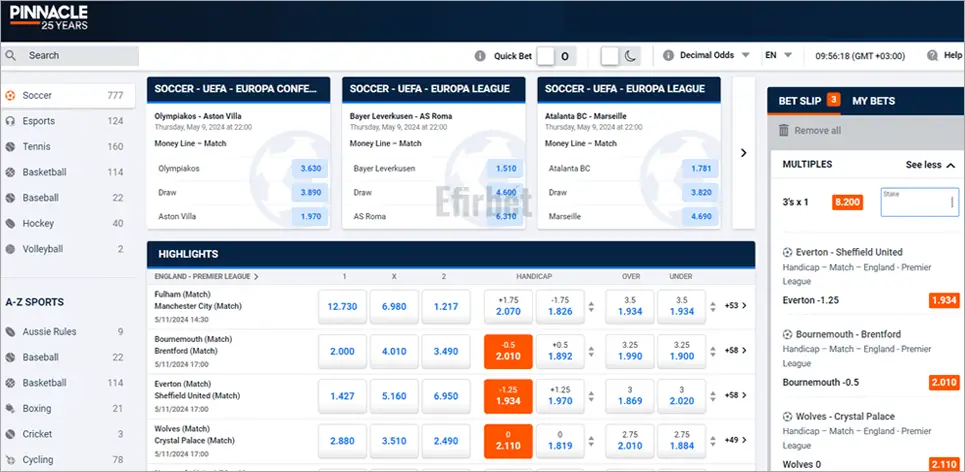

The sports betting industry thrives on promotions, flashy sign-up bonuses, “bet credits,” boosted odds, and aggressive marketing campaigns. Casual bettors often believe these offers represent real value. But beneath the surface, a more important question shapes long-term profitability: Are you getting the best odds, or are bonuses masking poor pricing? This debate between bonus value versus odds value sits at the heart of modern betting strategy.

This article examines that debate through a precise, mathematical lens. By comparing bookmaker margins, analyzing true market percentages, and modeling long-term betting outcomes, we demonstrate why Pinnacle’s low-margin, high-volume business model consistently provides more value than bonus-heavy operators. Pinnacle’s approach relies on 2–3% margins across virtually all markets, while the industry average often ranges from 5–7%, and some recreational-focused sportsbooks push margins as high as 10% or more.

Understanding how these margins work and how they silently “tax” every bet is critical for bettors of all experience levels. Whether managing a long-term bankroll or simply aiming to stretch betting dollars further, the numbers prove a simple truth: better odds beat big bonuses every time.

Understanding Betting Margins

Before comparing bookmakers, bettors must understand the key concept behind pricing: the margin, also called the vig, juice, or overround. The margin is the built-in profit a sportsbook earns by pricing outcomes slightly below their true probability. It’s not always visible, but it affects every wager and erodes bankrolls over time.

Market Percentage Explained

Market percentage represents the sum of the implied probabilities for every outcome in a betting market.

-

A 100% market represents perfectly fair odds that reflect true probabilities without any bookmaker edge.

-

Any percentage above 100% represents the margin.

To calculate the market percentage, convert the odds to implied probability and add them. For American odds, implied probability is computed as:

-

For negative odds:

|odds| / (|odds| + 100) -

For positive odds:

100 / (odds + 100)

Coin Toss: A 100% Market Example

Imagine a coin toss. True odds are 50/50, so fair prices would be +100 on both sides, creating a 100% market.

But sportsbooks never offer +100 on both sides. A typical recreational sportsbook might offer -110 / -110, raising the market to roughly 104.8%, while a high-margin book could price it at -115 / -115, pushing the market to nearly 107%. Pinnacle, in contrast, may offer -103 / -103, producing a 102% market.

These small numerical differences significantly impact bettor returns.

How Margins Affect Bettor Value

Margins determine how much value a bettor forfeits on every wager. Higher margins mean worse odds and a higher expected loss per bet.

For example:

-

At a 110% market, the house edge is 10%.

-

At a 102% market, the house edge is just 2%.

That difference doesn’t just show up once—it compounds across every wager.

Industry Context

Across major online sportsbooks:

-

Recreational books typically operate at 5–7% margins on popular sports.

-

Aggressive, bonus-heavy books often push certain markets to 8–10% or higher.

-

Sharp operators like Pinnacle maintain 2–3% on most sports and even lower on high-liquidity events.

Understanding these numbers lays the foundation for evaluating the unique value Pinnacle offers.

Pinnacle’s Margin Structure

Pinnacle’s business model is built around consistently lower margins. Instead of enticing customers with short-term bonuses or boosted odds, Pinnacle invests in maintaining market-leading prices across all sports and bet types.

2–3% Margins on Major Sports

Pinnacle’s pricing is particularly sharp in high-volume markets:

-

NBA sides: often 1.5–2.5%

-

NFL point spreads: 2–3%

-

Soccer markets: frequently 2% or less on top-flight leagues

-

MLB moneylines: averages 2–3%

These margins provide bettors near-true odds, dramatically reducing the long-term “tax” on betting activity.

Applied Across All Markets—Not Selectively

Many sportsbooks offer sharp odds on marquee games but increase margins on everything else. Pinnacle does the opposite.

The low-margin philosophy applies to:

-

Props

-

Totals

-

Halves and quarters

-

Niche sports

-

Live betting

Because customers can expect sharp odds everywhere, they aren’t forced to hunt for value.

Comparison to Industry Average (5–7%)

Most popular recreational-facing sportsbooks operate with noticeably higher margins. A typical NFL spread at -110 on both sides represents a 4.8% margin. Some books stretch spreads to -112 or -115, increasing the overround.

Over time, the difference between -110 and -104 spreads becomes enormous. Pinnacle’s -104 pricing cuts the effective cost of a bet by more than half.

High-Margin Books (10%+)

Certain local books and smaller global operators routinely post margins:

-

8–10% on moneylines

-

12%+ on props

-

Sometimes 15–20% on in-play markets

Bettors at these books effectively pay a massive hidden fee on every wager.

Pinnacle’s consistency—not occasional offers—sets it apart. Low margins aren’t a marketing tool; they’re the core product.

Mathematical Analysis: Margins vs. Bonuses

To fully understand why low margins outperform bonuses, we model real betting scenarios with practical numbers.

Scenario Setup

-

Starting bankroll: $1,000

-

Bet size: $50 per bet (5% of bankroll)

-

Number of bets: 100 bets

-

Expected win rate: 50% (typical for most bettors pre-vig)

We compare three situations:

-

Pinnacle-style 2% margins

-

Industry average 6% margins

-

High-margin 10% sportsbooks with a $200 sign-up bonus

Understanding Expected Loss Per Bet

Expected loss (EL) can be approximated by:

EL = Margin × Bet Size

Thus:

-

Pinnacle EL = 0.02 × $50 = $1.00 per bet

-

Industry average EL = 0.06 × $50 = $3.00 per bet

-

High-margin EL = 0.10 × $50 = $5.00 per bet

100-Bet Projection

-

Pinnacle: 100 × $1 = $100 expected loss

-

Industry average: 100 × $3 = $300 expected loss

-

High-margin book: 100 × $5 = $500 expected loss

The high-margin sportsbook’s $200 bonus does not cover its $500 expected loss.

Bonus Rollover Requirement Example

Most bonuses require wagering the bonus AND deposit multiple times.

Assume a $200 bonus with 10× rollover:

You must wager $2,000 to unlock the bonus fully.

At a 10% margin:

Expected Loss = $2,000 × 0.10 = $200

The entire value of the bonus disappears into the margin before you cash it out.

Break-Even Analysis

To equal Pinnacle’s long-term edge, a high-margin book must offer a bonus equal to the expected loss gap:

Difference in expected loss over 100 bets:

High-margin loss – Pinnacle loss = $500 – $100 = $400

A $200 bonus only covers half that gap. Even a $400 bonus requires rollover, further eroding value.

Long-Term Profitability

After 500 bets:

-

Pinnacle expected loss = $500

-

Industry average = $1,500

-

High-margin book = $2,500

Even a large deposit match bonus cannot keep pace with the compounding value gained from consistently lower margins.

Conclusion of Mathematical Proof

Low margins generate ongoing, compounding value. Bonuses provide one-time, diminishing value.

The math is absolute: in long-term betting, odds quality dominates everything.

The Economics of Low Margins

So how does Pinnacle sustain profit with lower margins when competitors rely heavily on it?

High Volume Over High Margin

Pinnacle operates on a high-volume model. Sharper odds attract sharper bettors and increase turnover. A small margin applied to millions of dollars in betting handle produces stable profits.

Operational Efficiency

Pinnacle does not rely on:

-

Heavy advertising

-

Television campaigns

-

Celebrity endorsements

-

Aggressive promotional spending

This cost structure enables them to keep margins lean.

No Bonus-Led Acquisition Costs

Recreational sportsbooks spend enormous sums on customer acquisition. A $1,000 bonus or bet credit costs the operator real money. Pinnacle does not compete in this arena, allowing it to reinvest in pricing instead.

Customer Lifetime Value (CLV)

Because Pinnacle offers better odds, bettors stay longer, wager more, and churn less.

Higher retention = greater lifetime profit per bettor without charging higher margins.

Market-Making Influence

Pinnacle’s lines are considered among the sharpest in the world. Their odds often anchor global markets.

This status provides liquidity, strengthening their efficiency loop.

The economics work because the business is structured around sustainable pricing, not “bonus burn.”

Pinnacle vs. Betting Exchanges

Betting exchanges like Betfair and Matchbook advertise “low margins” and “better odds,” but commission changes the equation.

Exchange Margin Claims

Exchanges often list markets close to 100–102%, similar to Pinnacle. But the commission on winning bets—typically 2–5%—reduces actual value.

Commission Impact Example

Suppose you win a $100 bet with a net profit of $95 at odds around -105.

If the exchange charges 3% commission on winnings:

-

Commission = $95 × 0.03 = $2.85

-

Real Profit = $95 − $2.85 = $92.15

This effectively increases the market percentage. A nominal 101% market becomes equivalent to 103–104% after commission.

Net Value Comparison

Across long-term betting cycles, Pinnacle’s no-commission model typically outperforms exchanges unless a bettor receives special commission discounts or consistently gets unmatched high-value prices from peers.

Liquidity Considerations

Exchanges depend on user liquidity. In smaller leagues, props, live markets, or derivative bets, liquidity is often thin.

Pinnacle sets lines and provides liquidity consistently, creating a smoother betting experience.

Bottom line: exchanges can offer value, but Pinnacle’s combination of low margins + no commission is often superior for most bettors.

Real-World Impact for Different Bettor Types

Different bettors benefit from low margins in different ways.

Recreational Bettors

Recreational bettors don’t wager high volumes, but margins still matter. Getting -104 instead of -110 improves the likelihood that their bankroll lasts longer, providing more entertainment for the same spending. Even low-volume betting feels different when odds are sharper.

Semi-Professional Bettors

Semi-pro bettors rely on finding edges. Pinnacle’s odds reduce the barrier for breakeven performance and make profitable strategies easier to sustain. A bettor who might be a -1% ROI player at -110 pricing could become a +1% ROI player at -104. That swing determines long-term viability.

Professional Bettors

Professionals operate on tiny edges and high volume. Margins are everything. Sharper odds reduce risk and lower variance. Pinnacle also welcomes winners—something most sportsbooks avoid—creating a stable environment for professional strategies.

ROI Calculations by Volume

Consider bettors placing:

-

500 bets/year:

Savings switching from 6% margins to 2% = $50 × 4% × 500 = $1,000 per year -

2,000 bets/year:

Savings = $4,000 per year -

10,000 bets/year:

Savings = $20,000 per year

Even recreational bettors feel the difference, but high-volume bettors experience a dramatic financial impact.

Conclusion

The sports betting marketplace is crowded with bonus offers, sign-up incentives, and boosted odds meant to attract short-term interest. But these promotions can’t disguise poor odds. As the mathematical evidence shows, bookmaker margins—not bonuses—determine long-term betting success. Pinnacle’s low-margin model, consistent pricing, and no-commission structure give bettors the best chance to retain more of their bankroll over time.

By prioritizing sharp odds over promotional gimmicks, Pinnacle delivers true, sustainable value. Recreational players enjoy longer-lasting bankrolls, semi-professionals find more opportunities for positive ROI, and professionals gain access to a reliable, transparent environment that rewards rather than restricts winning strategies.

For any bettor aiming to maximize value, understanding margins is essential. And once you understand how margins work, the choice becomes obvious: better odds beat bigger bonuses every single time.